Who is accountable for managing and protecting the U.S. consumer credit system? This was the focus of the U.S. House Committee on Financial Services when they had the opportunity to question the CEOs of the three largest credit bureaus in the country – Equifax, TransUnion, and Experian. The purpose of this committee hearing was to gain insights that will help craft newly proposed legislation aimed at providing solutions to some of the most prevalent concerns and complications faced by consumers negatively impacted by the credit system.

Click the links below to jump to that section

- Proposed Legislation

- About the Committee Hearing

- Data Breaches and Information Security

- Are the Bureaus an Oligopoly?

- Do Consumers Own Their Data?

- How Much Control do Consumers Have?

- Addressing Inaccuracies in Reporting

- Racial Disparities in Reporting

- Proposed Solutions to Credit Reporting Reform

- Testimonies Provided by the Panelists

Proposed Legislation

There are two bills being reviewed by this committee. The first is the Comprehensive Consumer Credit Reporting Reform Act of 2019 which could lead to significant impacts in the U.S. credit system through additional regulations, congressional oversight, and modifications to the type of information collected and reported by the major credit bureaus. The second bill being proposed by the committee is the Protecting Innocent Consumers Affected by a Shutdown Act which would require creditors reporting consumer financial records to omit negative information for a specified period of time for federal employees impacted by a government shutdown.

Most of the panelists were in favor of supporting federal workers impacted by the shutdown, whether through legislation or corporate programs, and the majority of the hearing was focused on questions related to the Comprehensive Consumer Credit Reporting Reform Act of 2019. This article will primarily focus on information related to credit reform.

About the Hearing to Hold Credit Bureaus Accountable

The hearing titled, ‘Who’s Keeping Score? Holding Credit Bureaus Accountable and Repairing a Broken System’ allowed various members of the committee to spend the day with a panel of experts within the credit system, and advocates proposing change.

The first panel consisted of credit bureau leaders including Mr. Mark Begor, CEO of Equifax since April 2018, Mr. James [Jim] Peck, President and CEO of TransUnion, and Mr. Craig Boundy, CEO of Experian North America.

The second panel of advocates included Ms. Lisa Rice, President and CEO of the National Fair Housing Alliance (NFHA), Ms. Chi Chi Wu, Staff Attorney for the National Consumer Law Center (NCLC), Ms. Jennifer Brown, the Associate Director of Economic Policy at UnidosUS, Mr. Edmund Mierzwinski, Consumer Program Director for the U.S. Public Interest Research Group (PIRG), and Mr. Thomas P. Brown, a partner at the Paul Hastings law firm (although Mr. Brown made clear he participated with the panel on his own accord, and not as a representative of his firm).

Prior to reviewing the contents of the hearing, it’s worth noting current regulatory measures in place for the credit reporting industry. Current Federal regulations consumer reporting agencies (including the three credit bureaus) are required to abide by include: the Fair Credit Report Act (FCRA), the Foreign Corrupt Practices Act (FCPA), the Gramm-Leach-Bliley Act (GLB), and the Dodd-Frank Act. The industry is also overseen by government regulators including: the Consumer Financial Protection Bureau (CFPB), the Federal Trade Commission (FTC), and additional oversight committees, agencies, or bureaus as it pertains to the type of data being regulated, for example, Housing and Urban Development (HUD) with regards to housing best practices.

This is a war. It’s a war every company faces, or every government agency faces, whether you’re a credit bureau, a financial institution, or industrial company, there are criminals in nation-states that are attacking us.

Mark Begor, CEO of Equifax

Data Breaches and Information Security

The introductory comments made by the Chairwoman of the committee, Maxine Waters (D-CA), provided background on what lead the committee to propose the new legislation. Among the most prevalent was the 2017 Equifax data breach that exposed the personally identifiable information (PII) of 148 million American consumers. In addition to this breach there have been other instances in which a sizable client of Experian exposed 15 million consumers’ PII, and in 2013 when all three bureaus identified unauthorized access to sensitive data.

Mr. Mark Begor became the CEO of Equifax in April 2018 (several months after the breach was announced) and has been instrumental in evaluating potential damages, and implementing new policies, procedures, and expenditures intended to protect and support consumers. “This is a war. It’s a war every company faces, or every government agency faces, whether you’re a credit bureau, a financial institution, or industrial company, there are criminals in nation-states that are attacking us” said Mr. Begor.

In response to the breach Equifax is investing $1.25 billion in incremental investment between now and 2020 to enhance information security practices, and consumer experiences. The other panelists added that TransUnion invests $500 million annually, and Experian invests $1 billion annually towards cyber security enhancements and preventative measures. These investments include ensuring that all three bureaus maintain compliance with the National Institute of Standards and Technologies (NIST) updated cyber framework released in 2018, and the Federal Trade Commission (FTC) Safeguard Rules.

All three of the panelists representing their respective organizations made clear that they are taking considerable efforts in enhancing consumer data protections, including complying with the passage of S.2155 and providing access at no cost for consumers to lock and unlock access to their credit profile at will.

How to Lock and Unlock Your Credit

Do the Bureaus Represent an Oligopoly?

A concern that was raised at multiple points throughout the hearing was determining whether the three credit bureaus operate as an oligopoly. While no definitive ruling was made regarding this concern, the general consensus was that, by definition, the bureaus do fit within this structure of operation.

There are a large number of specialty consumer reporting agencies that collect consumer information and sell data products for a variety of industries including, but not limited to, rental housing (tenant screening), companies and organizations (employment screening), and various types of insurers. While these types of agencies significantly outnumber the three major bureaus, none of them represents a size or market share substantial enough to pose a legitimate threat, and companies that do provide unique solutions tend to be acquired by one of the bureaus or other organizations.

During the second panel, Mr. Thomas Brown, an Antitrust lawyer and Partner at Paul Hastings law firm, expanded on complications he sees with promoting or requiring competition within the credit bureaus’ market. He cited section 1 of the Sherman Antitrust Act which makes it difficult for companies who compete with each other to collaborate, and the FCRA which he considers to be extremely technical and a barrier to entry in the market for other competitors. In addition to these challenges, Mr. Brown added that it’s a daunting task for companies to want to take on the bureaus given the complexities involved in simply forming the relationships required with data furnishers to collect enough consumer information needed to compete.

The question of whether the structure of the bureaus’ business fits the description of an oligopoly to the extent that Congress will see fit to regulate and dismantle the system remains to be unseen at this time.

Do Consumers Own Their Data?

Yes. The leaders of the three bureaus made clear that their stance is consumers own their own data, and have a direct say in it. What appears to be evolving with new programs and technology is how much control consumers have over their data.

In the past, there have been limitations for consumers to opt-in or out of how their credit is being used, who can access their consumer profile, and ways to control what data is being furnished to the bureaus. While it’s true that consumers have their information automatically reported to the bureaus by various types of creditors, there is opt-in language written into terms and conditions contracts before establishing new lines of credit. Opting out of these programs isn’t transparent for most consumers, however, the need for information to be reported accurately and consistently is critical in order to provide the most benefits for future credit-related decisions.

The FTC provides a resource for opting out of various types of credit programs here: Click Here

Consumers can also lock/unlock access to their credit with the three bureaus: Click Here

How Much Control do Consumers Have?

Innovations in credit reporting technologies over the last few years have lead to giving consumers better control over having positive payment accounts incorporated in their credit reports and scores. TransUnion has been developing Trended Data in which Mr. Peck, President and CEO of TransUnion, cited to have shown 60 million consumers having transitioned from being credit invisible to credit visible as a direct result of the program. Equifax has been developing NeuroDecision Technology that can improve algorithms to extend credit to more consumers, and Experian is preparing to launch their Experian Boost product that gives consumers the ability to manually report positive payments, such as rental payment history, to the bureau.

All of the bureaus also offer resources intended to support and educate consumers about their rights and access to their data. For example, Experian offers a Credit Educator Program specifically designed as a free resource to help consumers understand the various complexities surrounding their own data.

The FCRA requires companies to provide consumers with a summary of rights whenever an adverse action is taken based on credit-related decisions. This document assists consumers in understanding who to contact, and how to proceed in follow-up activities related to decisions based on their consumer profile.

Addressing Inaccuracies in Reporting

One of the most prevalent areas of concern with the proposed legislation to reform credit reporting is regarding how best to respond and assist consumers negatively impacted by data inaccuracies. It’s a troubling situation when a consumer’s application is denied based on information that’s incorrect, and can lead to loss of housing, employment, or much-needed extensions of credit.

The reform act proposed by Chairwoman Waters has language intended to permit consumers the option to appeal when a judge rules against them in court over information in their credit profile they assert to be incorrect. As most courts tend to rule in favor of the bureaus this would provide additional time and investigation for consumers to correct their reports in the most extreme situations. Most consumers aren’t required to go to court as the bureaus each have dispute resolution processes to assist with correct inaccuracies.

As required by the FCRA a consumer must be responded to regarding their dispute within 5 business days, and the investigation process must be completed within 30 days from the date the notice was received. The leaders of the three bureaus all confirmed they comply with this process, and that nearly 50% of all disputes received are resolved within two weeks. Whenever a dispute is resolved, and information is corrected, the changes required for the consumer’s report take effect near immediately.

Additionally, Congressman Barry Loudermilk (R-GA) presented a CFPB statistic citing Experian to have received 95,000 negative consumer complaints which equates to 0.05% of all consumers. A figure the congressman asserted is unlikely to be improved by additional government oversight or involvement in the process.

While the current dispute process complies with the FCRA there is room for improvement as decisions are made more quickly given current technology and culture, and credit is utilized much more broadly across different industries that impact consumers’ ability to live their life.

In March 2018, Experian launched an enhanced consumer dispute portal in an effort to simplify the process. The bureau also stated it performs more than 400 accuracy checks on all data submitted by furnishers before adding it to consumer reports. TransUnion provides a button on all digital consumer credit reports that redirect them to begin the dispute process immediately if any information is found to be erroneous. Since the breach, Equifax has also been increasing how they address inaccuracies through data auditors, a data quality team, $50 million in investments to develop new technologies to simplify the dispute process, and refusal to accept data from furnishers who have exceeded a threshold for providing inaccurate information.

Racial Disparities in Credit Reporting

A concern shared by some committee members and primarily advocates of the second panel is the disparate impacts that the current credit system has on minority populations. The transition to more predictive and information-based systems over the last few decades has been intended to alleviate racially-based decisions by relying on objective information.

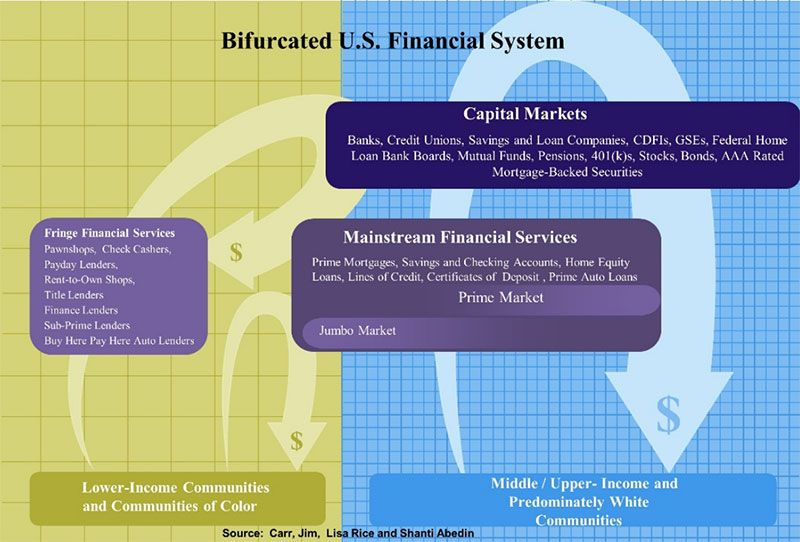

Ms. Lisa Rice, President and CEO of the National Fair Housing Alliance (NFHL), provided research in her testimony to demonstrate how some consumers have become credit invisible. In her testimony, she presented a chart (below) that separates legitimate financial institutions that report data to the bureaus, and fringe financial services that don’t.

The disparate impact of this outcome is due to the prevalence of alternative financial services in lower-income communities that trend towards higher populations of Black, Latino, and Native American consumers. Additionally, Ms. Rice’s testimony discusses variations in cultural management of household finances, for example when families avoid debt by paying cash which leaves them being credit invisible.

Ms. Jennifer Brown, Associate Director for Economic Policy at UnidosUS, presented findings within her testimony to support the claim that the current system has more negative repercussions for minorities and consumers with lower income leading to an increase in the wealth gap. In Ms. Brown’s testimony, she cites a Federal Reserve Board report produced in 2007 that found the average credit score of Black Americans were approximately 50%, and Latino Americans approximately 33%, lower than White Americans.

Moving beyond lower credit scores is the rising concern over being considered ‘credit invisible’, when the bureaus don’t have enough information in a consumer profile to provide a complete report or produce a credit score. The consequences of being credit invisible can include denial of employment or housing and utilities, which leads to a cycle that consumers struggle to break free from. Essentially having a lower income leads to poor results during a credit check which prevents consumers from gaining employment, and ultimately forces them to remain in poverty.

The complex issues behind addressing racial disparities in credit reporting present a challenge for applying solutions that can modify a system intended to be objective without creating unintended consequences.

Mr. Peck discussed studies conducted on removing negative data from credit reports that lead to increased costs for consumers. When credit decision makers are presented with less information with which to base their decision, they attempt to protect their investments by increasing fees and rates, or in general charging more for extending lines of credit. While Mr. Peck was not against the consideration of removing harmful data from credit reports, he attempted to stress the importance of conducting proper research to determine the potential repercussions. In an effort to combat credit invisibility all three bureaus are also developing more solutions for consumers to self-report on common accounts such as utility bills and rent payments.

Both panels of experts had solutions to these problems, and more, that they believe could positively impact the system.

Proposed Solutions to Consumer Credit Reform

There were a large number of solutions proposed by the panelists that can be read in their individual testimonies below. A handful of proposals were revisited multiple times during the hearing and will be presented here.

How to Lock and Unlock Your Credit

- The general consensus of the credit bureau leaders is that providing more opportunities to self-report information, and improving technologies for expediting the dispute process will lead to reductions in data inaccuracies. All of the bureaus have already been developing these enhancements for some time, and have seen positive results.

- There was unanimous support on the advocates’ panel, and mixed support on the bureaus’ panel for implementation of an appeals right for consumers who lose in court when disputing inaccurate data. The appeals process is included within the proposed legislation for more extreme cases of consumers attempting to clean up their profile.

Reduce the amount of negative data

- The bureau leaders are open to studying the impacts of removing some types of information from credit reports that have a negative impact on consumers, but strongly warn that research should be conducted first due to unintended consequences that might arise. There have also been steps taken in recent years to assist consumers by removing or factoring out medical debts, and removal of the majority of civil judgments and up to 50% of tax lien data. These reductions in negative data were the direct results of the implementation of the National Consumer Assistance Plan (NCAP) over the last two years.

- Additional recommendations by the second panel include reducing the time negative information remains on credit reports from seven to four years, removing negative information from predatory loans, and no longer accepting data from furnishers who don’t report positive payment histories.

Improve positive data and decrease the number of credit invisible consumers

- Incorporating more data and improvements to algorithms is the primary recommendation from the bureaus. Experian and TransUnion both offer consumers a program to self-report additional payment accounts such as rental history and phone bills, and Equifax has developed a machine learning program to provide more intelligent insights to predict creditworthiness.

- The advocates’ panel was directly asked about combating credit invisibility with Ms. Brown recommending better access to legitimate financial institutions that report data to the bureaus, and Ms. Wu proposing avoidance of using alternative data that has a negative impact on consumers. Ms. Wu also recommended incorporating bank data, such as checking and savings accounts, into credit reports.

Protect consumers from identity theft and fraud

- The bureaus have already implemented free tools for consumers to put a lock or freeze on their consumer profile to prevent unauthorized access. These systems are already available to all consumers. Mr. Begor also described additional steps being taken to curb synthetic fraud such as heavy investment in multi-factor authentication technology, an improved I.D. coalition researching alternatives to relying on social security numbers, and increased vigor around identity verification.

- The second panel were all in agreement that they don’t see a problem with using the social security number as an identifier to distinguish between consumers with similar information (ex. John Smith), but believe there needs to be better methods to verify and authenticate consumers when proving their identity to access sensitive information.

Testimony Provided by the Panelists

Panel 1

Panel 2

- Ms. Lisa Rice, President and CEO of the National Fair Housing Alliance (NFHA): Written Testimony

- Ms. Chi Chi Wu, Staff Attorney at the National Consumer Law Center (NCLC): Written Testimony

- Ms. Jennifer Brown, Associate Director of Economic Policy at UnidosUS: Written Testimony

- Mr. Edmund Mierzwinski, Consumer Program Director for the U.S. Public Interest Research Group (PIRG): Written Testimony

- Mr. Thomas P. Brown, Partner at Paul Hastings law firm: Written Testimony

Proposed Legislation

It’s early in these discussions to predict whether the proposed legislation in its current form will receive approval, however, many of the concerns addressed during this hearing are unlikely to go away without changes in technology, policy, or reporting practices. While it may not be perfect, the bureau leaders repeatedly addressed that the U.S. credit system is the envy of other developed nations as it offers the most predictive and objective methods of decision making. Any significant changes to this system should be weighed heavily, and researched thoroughly, in order to best avoid unintended consequences that could harm consumers.