Finding the right tenants for your property in most cases means you have to search for a stranger you can trust with one of your most expensive assets. The right tenant will pay their rent on time and treat your property with respect, however, the wrong tenant might drag you through costly court battles and expensive repairs. The best way to mitigate your risks so you select the most qualified tenants using trustworthy information in legally approved ways is to understand the process of using tenant background checks.

The Essential Guide to Tenant Credit & Background Checks

- Save Time by Pre-Qualifying Rental Applicants

- Properly Inform Applicants About Your Rental Criteria

- Understand Fair Housing Requirements

- Objective versus Subjective Information

- Avoid Using Bright-Line Standards

- Identify Fraud with Red Flag Rules

- What to Look for in Tenant Credit Checks

- Safely Rely on Criminal and Eviction Records

- Legally Follow-up with Adverse Action Notices

Pre-Qualifying Rental Applicants

Pre-screening rental applicants should be every landlord, real estate agent, or property manager’s first step after a potential renter inquires about a property. It saves you, and your potential renters, time and money by avoiding a more lengthy and invasive process when you might be able to determine upfront if the applicant is unqualified.

The rental pre-screening process is essentially just a verbal interview in which you have the opportunity to inquire about your applicant’s past and present renting history. It also gives your applicants an opportunity to decide whether they will be able to meet with your rental criteria and requirements. While a tenant background check will divulge objective information about an applicant’s credit, criminal, eviction, and possibly other histories, the pre-screening process is more likely to provide you with subjective insights. This is also a good time to get a feeling for whether you will be able to trust your applicant as a tenant who will treat your property with the kind of consideration you desire from a renter.

Beyond the benefit of saving time and money during the rental application process, pre-qualifying rental applicants is also your opportunity to explain the most important aspects of your rental criteria that might make or break whether they will be approved.

What Applicants Need to Know

If you have a well-defined rental criteria (which you should) then it’s something you should cover with applicants as early in the process as possible. As much as you may not want to deter anyone from renting your property, you also don’t want to spend time scheduling showings or completing tenant background checks on anyone who is simply unqualified.

Your defined rental criteria will most likely have some requirements that you just refuse to make concessions on. Similarly, you might have some rental requirements that you would like for all tenants to meet, but you’re also willing to concede a little if they are qualified in other crucial areas.

Some common criteria you should cover early on when speaking to potential applicants include:

- Minimum monthly income required to afford the rent.

- Any specifics regarding acceptable credit, such as a threshold for minimum credit score accepted or no more than 3 collection accounts (not including medical debts).

- Specific types of criminal convictions, and the time since conviction. (eg. Property damage exceeding $1,000 within the past 3 years)

- More than two eviction judgments and/or filings within the last 3 years.

- Whether you have a policy against accepting pets, or any specifics regarding pets.

Fair Housing Guidance

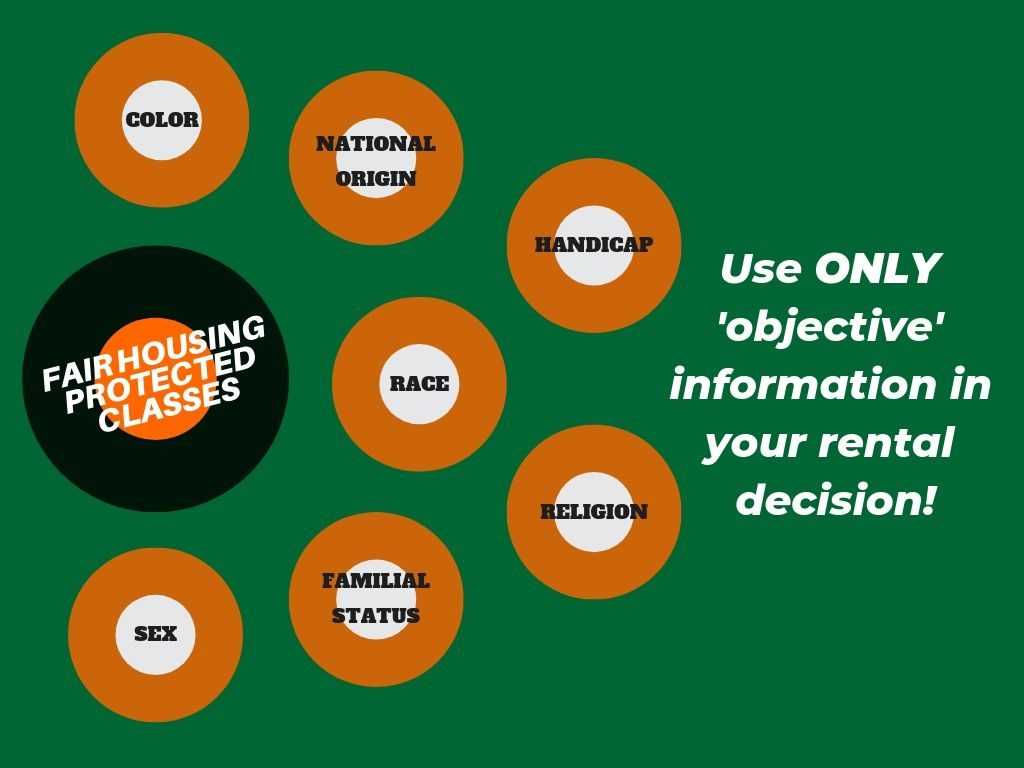

The Fair Housing Act (FHA) dates back to the civil rights movement of the 1960s. More specifically it is an act passed as a follow up to the Civil Rights Act of 1964 that became the Civil Rights Act of 1968 with Title VIII (the actual Fair Housing Act), becoming the pertinent portion related to housing. The FHA was, and still is, a significant stride towards eliminating racism and prejudice within housing industries to ensure fair and equal rights to housing for everyone with regards of seven (7) specially protected classes.

7 Protected FHA Classes

Another topic that has been picking up steam in recent years is regarding the impacts of Disparate Impact in housing. Disparate impact refers to unintentional discrimination from policies that result in a select minority, or otherwise protected class, being adversely affected at a higher rate than other groups. In 2015 the Supreme Court ruled in favor of allowing lawsuits on the basis of disparate impact which means you should look closely at your policies to ensure they may not be having a disproportionately adverse effect on a select group of people that may fall into one of the seven protected classes.

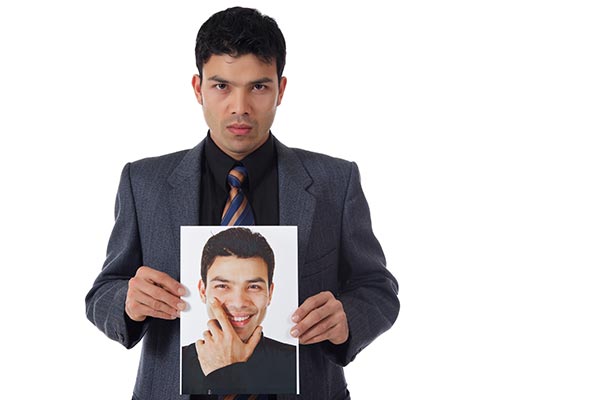

Objective versus Subjective Information

Understanding the difference between relying on objective rather than subjective information in your decision can be a defining factor in protecting yourself from accidentally discriminatory practices.

Objective information is fact-based, coming from sources that can be authenticated and verified for accuracy. This would include credit reports, public records such as criminal or eviction records, and rental payment history (if reported).

Subjective information is more opinion-based derived from interpretations, judgments, emotions, or other types of less verifiable sources. This would include reports coming from a person’s social media history, overly detailed references providing verbal information related to an applicant’s character based on their opinions, or judgments made about a person’s appearance.

When relying on information obtained for determining whether an applicant is qualified for a rental property it’s critical that your decision is made based only on objective information. Subjective information may help you come to a decision, but ultimately it will land you in legal trouble if an applicant disputes the reason(s) for their denial. With objective information, you have verifiable information to demonstrate the reasons for your decision based upon the applicant’s reported history by credit bureaus and data furnishers that directly relate to their trustworthiness as a renter.

Bright-line Standards

A Bright-Line Standard is a clearly defined rule that is composed of objective factors that leave little to no room for interpretation. While this sounds like something that would be beneficial as part of your rental criteria, the problem is it doesn’t account for variations from local, state, or federal jurisdictions.

For Example: A policy that states you will not approve an applicant with a felony on their record does not account for what defines a felony in different states. Currently, in the U.S., there are states that completely prohibit the use of marijuana while other states are making it one of their most profitable cash crops.

Adding specificity to your policy about the types of criminal convictions, for example, that will result in a denial decision can help you avoid having bright-line standards.

Examples of specifying rental criteria:

- No convictions stemming from property related crimes.

- No violent or sex-related offenses within the past 5 years.

- No sex offenses that prohibit an applicant from being with xxx feet of a place where children congregate.

Red Flags

Also known as the Fair Credit Reporting Act’s Identity Theft Rules, Red Flag Rules refer to the guidance used to determine when an applicant may be attempting to commit identity fraud. According to the Federal Trade Commission (FTC), if you have access to credit then you must also have reasonable policies and procedures in place for detecting, preventing, and mitigating identity theft.

Common methods used to adhere to the FTC’s requirements include having a written procedure which spells out what actions will be taken to check and verify the applicant’s identity should there be any type of fraud warning on the credit report.

Examples of verifying the applicant’s identity include requiring additional documentation such as a government-issued photo I.D., social security card, or current utility bills. Some of these may be required as part of the overall rental process, and others might be a secondary method of verifying the applicant’s identity.

Common red flags to look out for:

- No rental history

- Gaps in rental history

- Incomplete or illegible application

- Torn, faded or altered documentation

- Negative information from prior landlords

- Eviction filings or judgments

- Unverifiable addresses

- Prior landlords who are members of the applicant’s family

- Information doesn’t match from one document to the next

If you are unable to verify the applicant’s identity and have reason to suspect identity theft may be a factor, then you should not approve renting to the individual. You are also under no obligation to report the potential identity theft to law enforcement, however, you are required to provide the applicant with an adverse action letter so they may dispute any inaccuracies directly with the organization that reported the information – most commonly the credit bureau or tenant screening company.

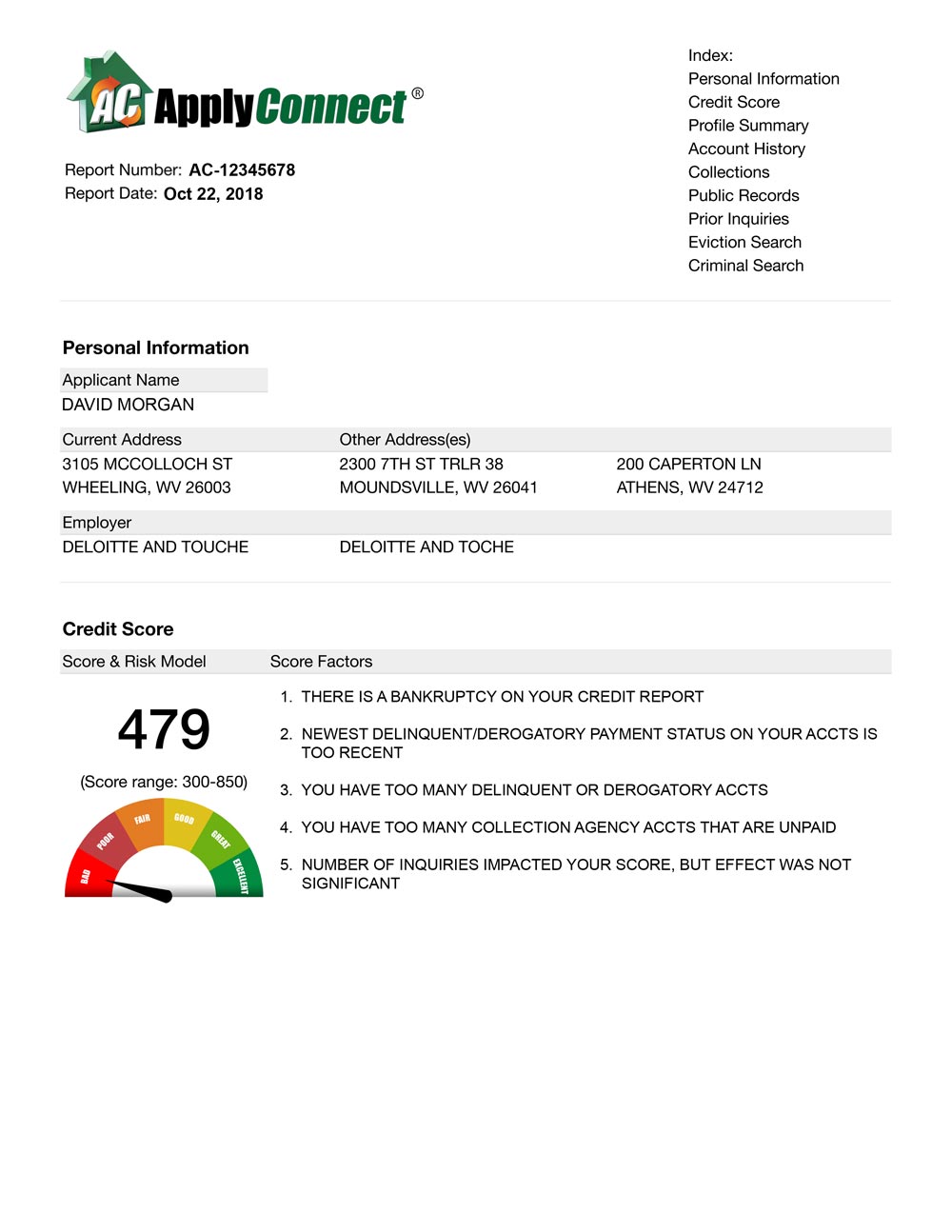

Tenant Credit Checks

Credit checks on tenants are classified as a consumer report which means it delivers information regarding a consumer’s credit worthiness, credit standing, credit capacity, character, general reputation, personal characteristics or mode of living (lifestyle) to be used for a specific purpose – in this case, tenant screening. These types of reports rely on objective data that can be verified without any bias. When information of a subjective nature, such as personal interviews with prior landlords or employers, is primarily used it becomes classified as an investigative report which has different requirements that must be adhered to.

For the purpose of tenant credit checks, you want to be certain you are relying on consumer reports provided from one of the 3 major credit bureaus – Experian, TransUnion, or Equifax. These reports should include objective information such as:

- Previous known address history

- Fraud verification as part of the red flag review process

- Credit-related accounts (tradelines) with payment history

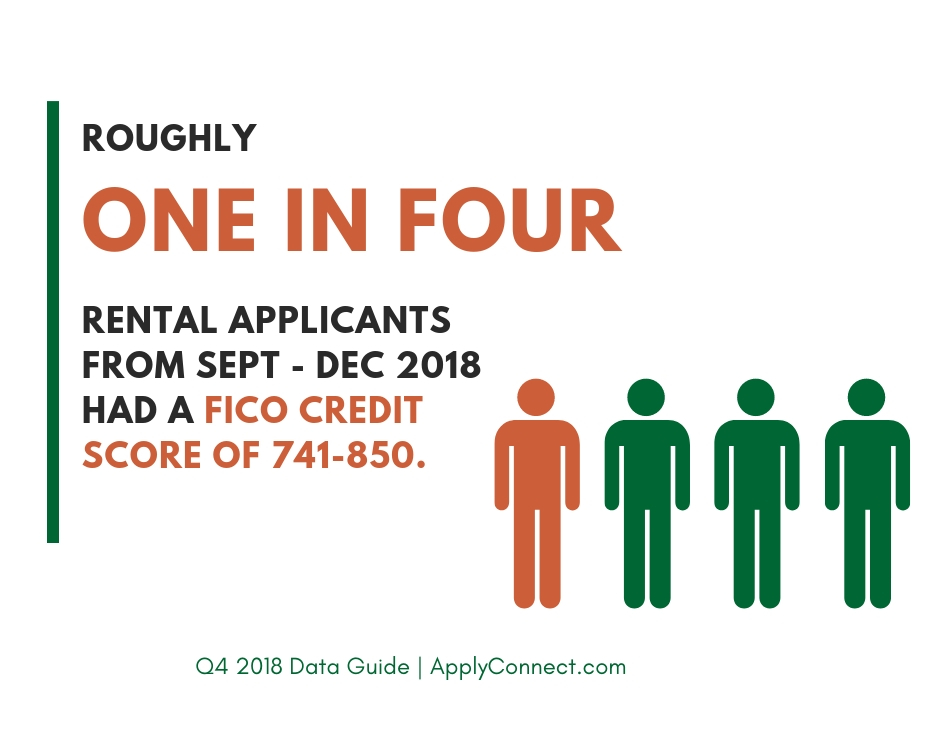

- A FICO or VantageScore risk model to analyze overall credit

- Collection accounts

- Public records

All of this information is acquired based on the consumer’s credit and payment habits rather than anything that can be influenced by an opinion which is what makes it the safest option for qualifying potential renters.

Tenant Background Checks

Eviction records and criminal histories will generally round out the key aspects of a tenant background check. What’s important to note about these portions of the report is that they differ greatly from the consistency you can expect in the tenant’s credit check. While there are only 3 major credit bureaus reporting much of the same information, there are a variety of options regarding how tenant screening companies can complete the remaining elements of the tenant background check.

Eviction reports are developed by compiling public record information from courts around the country. There is no singular source for this information, and the way the information is cleaned and organized can vary greatly between tenant screening companies.

What to be aware of when reviewing eviction records:

Eviction Filings

An eviction filing does not mean the tenant violated a previous lease and was evicted. It means there was an attempt to evict that applicant which may have come from a variety of reasons. It’s best to consider information that may explain the reason for the filing, and how many filings might be on the report. An isolated incident might have a reasonable explanation, but a history of repeated filings may indicate a troublesome renter.

Eviction Judgments

Unlike with filings, a judgment means the applicant was evicted by the court and a judge officially ruled in favor of a previous landlord. A judgment might have some type of monetary factor in which the tenant had to pay back costs to the landlord, or might have simply had to vacate the premises by court order. Judgments are generally the safest portion of information to use in making a decision, and multiple judgments against the applicant indicate a repeated pattern of poor tenant behaviors that resulted in lease violations.

Evictions on Credit Reports

Evictions will not appear on the credit report. In the past, there may have been some cases in which a monetary judgment showed up as a public record on the credit report, but since 2017 when the credit bureaus adopted new standards as part of the National Consumer Assistance Plan (NCAP) all of this information has been removed. The most reliable way to receive a complete picture of an applicant’s eviction history is to trust a 3rd party report provided by a tenant screening company.

Criminal histories, while still containing records from the court, differ from eviction reports in a number of ways. There are additional rules when reviewing a tenant’s criminal background check as to what types of records are legally allowed to be used in your decision as well as how long ago the applicant may have broken the law.

When using criminal records in your tenant background check be aware of:

Click each tab for more information

An arrest without a conviction means that the person was not found guilty of committing a crime. HUD released guidance in 2016 regarding this distinction so if you see an arrest on your criminal report pay close attention to whether it resulted in the applicant being convicted of a crime before making your decision.

In most states, a criminal conviction for use in tenant screening reports can only be reported for either 7 or 10 years from the date of conviction with most screening companies sticking to the 7-year rule. Exceptions to this rule can occur if the conviction involves highly violent crimes (example: murder), or credit transactions exceeding $150,000.

Sex offense records are stored by a variety of sex offender registries, and may not be included by default in every tenant background check. Be sure you clarify whether a report will include this information.

There is no national database of criminal records that all tenant screening companies can rely upon which means the information in the report can vary greatly between providers. As an extra level of due diligence, you should plan to cross-reference any criminal records that appear on the report which include physical descriptors of the applicant with your applicant’s government-issued ID, or personal knowledge of having met the applicant. For example, if the criminal record describes a middle-aged male, but your applicant is female, then you should contact the tenant screening company to provide additional research before making a decision.

In general, it is a recommended best practice to consult with your tenant screening provider about the accuracy of criminal records before issuing your decision.

Denying Applicants / Adverse Actions

An Adverse Action is the term used whenever denying an applicant housing based on information contained within a consumer report. Whenever you review a consumer report and don’t approve the applicant for the rental property you are required to notify them either in writing, orally, or by electronic means.

Your adverse action must include:

- The name, address, and telephone number of the company that provided the report used in making your decision. In this case, it would be the tenant screening company (also known as a Consumer Reporting Agency).

- A statement that the tenant screening company did not make the decision to deny housing, and cannot explain why the decision was made.

- A statement notifying the consumer of their right to obtain a free copy of their report directly from the tenant screening company within 60 days.

- A statement informing the consumer of their right to dispute the information in their report directly with the tenant screening company if they believe it to be inaccurate.

Most tenant screening companies should have examples or options built into their system to help you provide this information to your applicant. If not, then they should be able to assist you with guidance if you have any concerns over properly completing the process.

As a general rule of thumb, if you aren’t confident about information in your tenant credit or background check then you should contact the tenant screening company that provided the report. Most reputable companies will provide you with methods to contact them, and offer assistance that will lead to you making a well-informed decision about who you can trust to live in your property.