ApplyConnect Credit Reports

You use credit reports to determine if your rental applicants are financially responsible, and you deserve to get quality, easy-to-read credit reporting information from your tenant screening company. With ApplyConnect’s credit reports, you’ll get the credit data you need straight from Experian. Our reports start at $39.95 (paid for by the renter, unless you wish to cover the cost) and process in a matter of seconds. See our tenant screening guidance for more help on how to start on the right foot!

ApplyConnect Credit Reports

You use credit reports to determine if your rental applicants are financially responsible, and you deserve to get quality, easy-to-read credit reporting information from your tenant screening company. With ApplyConnect’s credit reports, you’ll get the credit data you need straight from Experian. Our reports start at $39.95 (paid for by the renter, unless you wish to cover the cost) and process in a matter of seconds. See our tenant screening guidance for more help on how to start on the right foot!

Tenant Screening, But Simple.

Getting started with ApplyConnect tenant screening can be accomplished in just three steps!

Simply complete a quick form and create an account! After filling out the short registration form and having your identity verified by Experian, you’re good to go. Not only is this process something that can be completed quickly, but it’s also free.

After creating an account the applicant will then purchase their own report (want to pay for the report? You can!), and give consent for it to be shared with you, creating a win-win scenario! Their credit score is unaffected because they shared it with you, and you have more money in your pockets. Win win!

View, Print, and Fill That Vacancy

ApplyConnect reports are processed within a matter of seconds after the applicant has paid. You’ll receive an email alert when the report is available, and can be viewed easily from your account dashboard. Now you have all the tenant information you need to make an informed decision.

Simply complete a quick form and create an account! After filling out the short registration form and having your identity verified by Experian, you’re good to go. Not only is this process something that can be completed quickly, but it’s also free.

After creating an account the applicant will then purchase their own report (want to pay for the report? You can!), and give consent for it to be shared with you, creating a win-win scenario! Their credit score is unaffected because they shared it with you, and you have more money in your pockets. Win win!

View, Print, and Fill That Vacancy

ApplyConnect reports are processed within a matter of seconds after the applicant has paid. You’ll receive an email alert when the report is available, and can be viewed easily from your account dashboard. Now you have all the tenant information you need to make an informed decision.

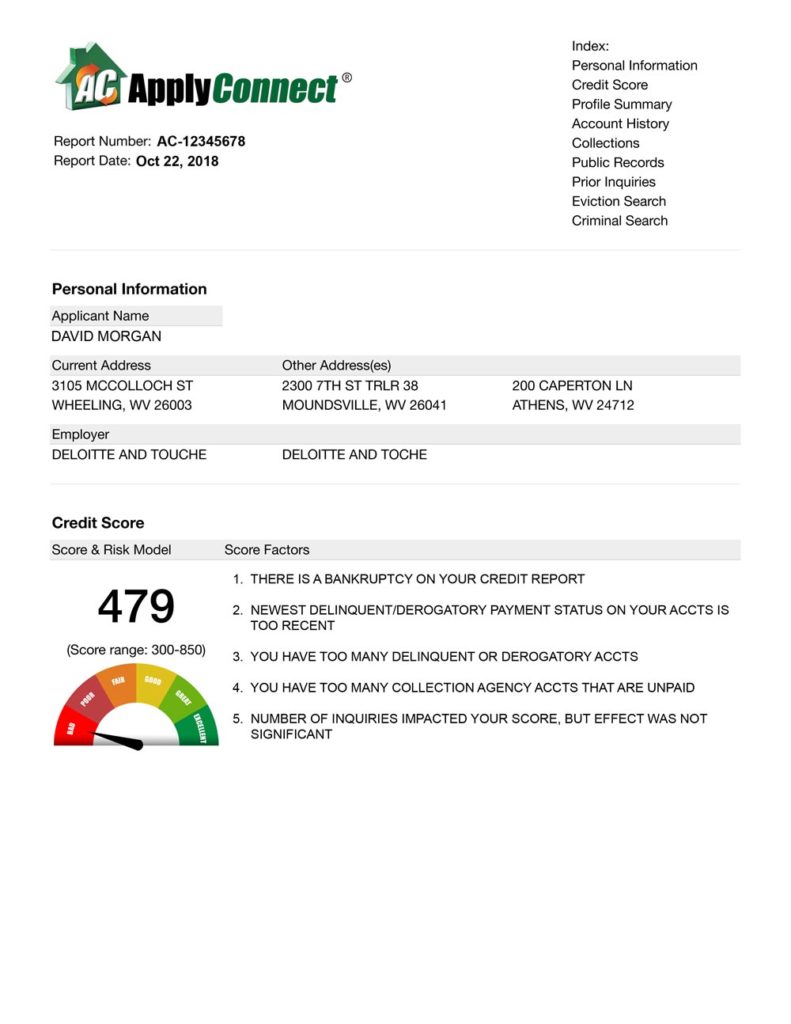

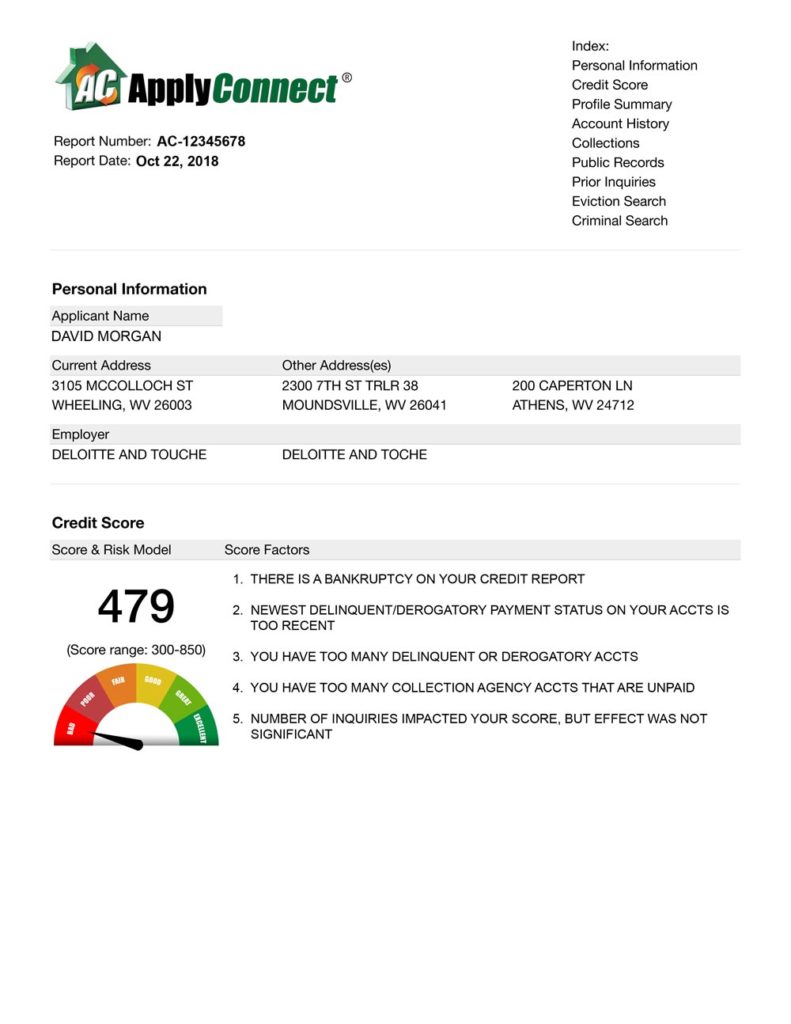

Renter Credit Checks Loaded with Information

Experian Credit Report

Each Experian credit report begins by displaying the applicant's information as available within their consumer profile with the bureau. ApplyConnect reports also begin with a visual aid to show the applicant's credit risk score, as calculated using the VantageScore.

- Applicant Name

- Current Address

- Previous Address(es)

- Employer

- VantageScore

- Credit Score Risk Factors

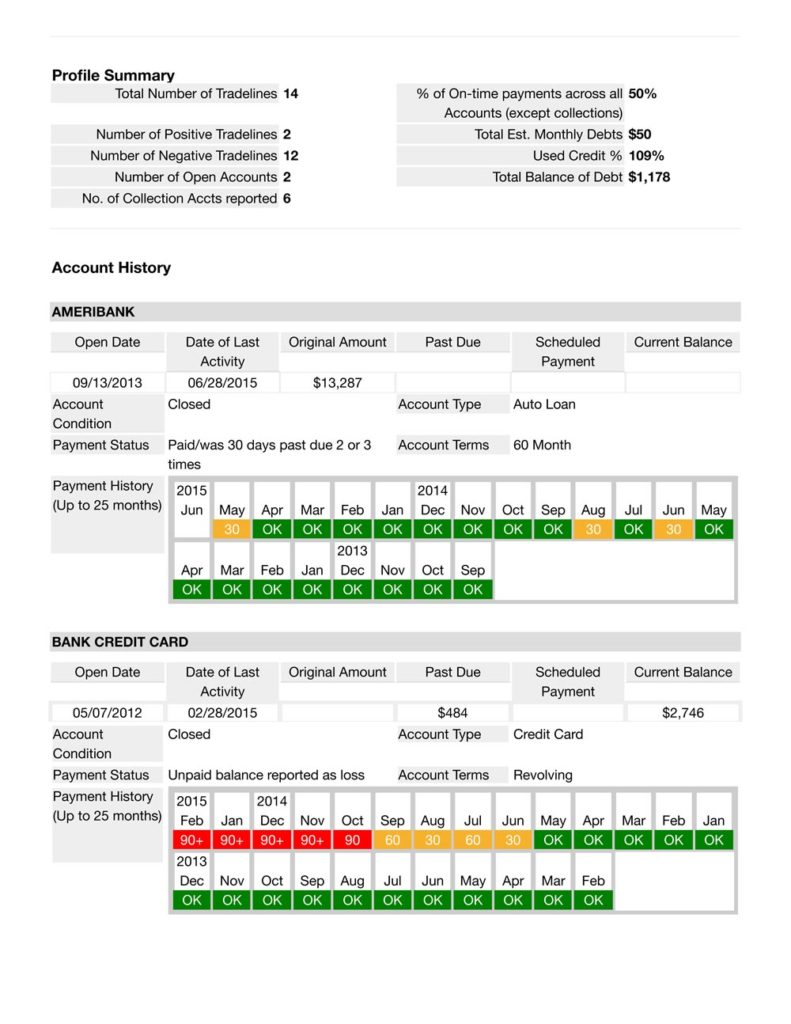

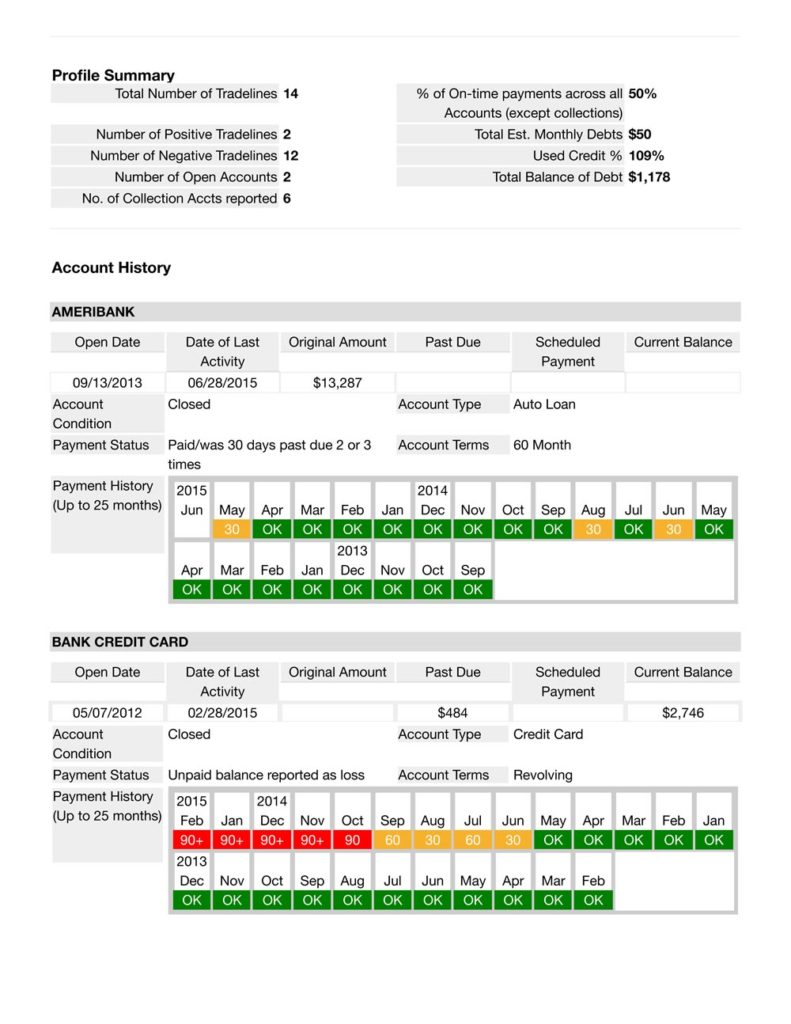

Profile Summary and Payment History

Summary and Tradelines

ApplyConnect credit reports include several pages of tradelines demonstrating the applicant's payment history, and a summary on top to provide an easy to read overview that can help in decision making to determine whether they are likely to pay rent on time.

- 24 Month History

- Real Estate Accounts

- Revolving Credit

- Installment Accounts

- Total Open Accounts

- On-Time Payments

- Late Payments

- Monthly Debts (est.)

- Available Credit

- Collection Accounts

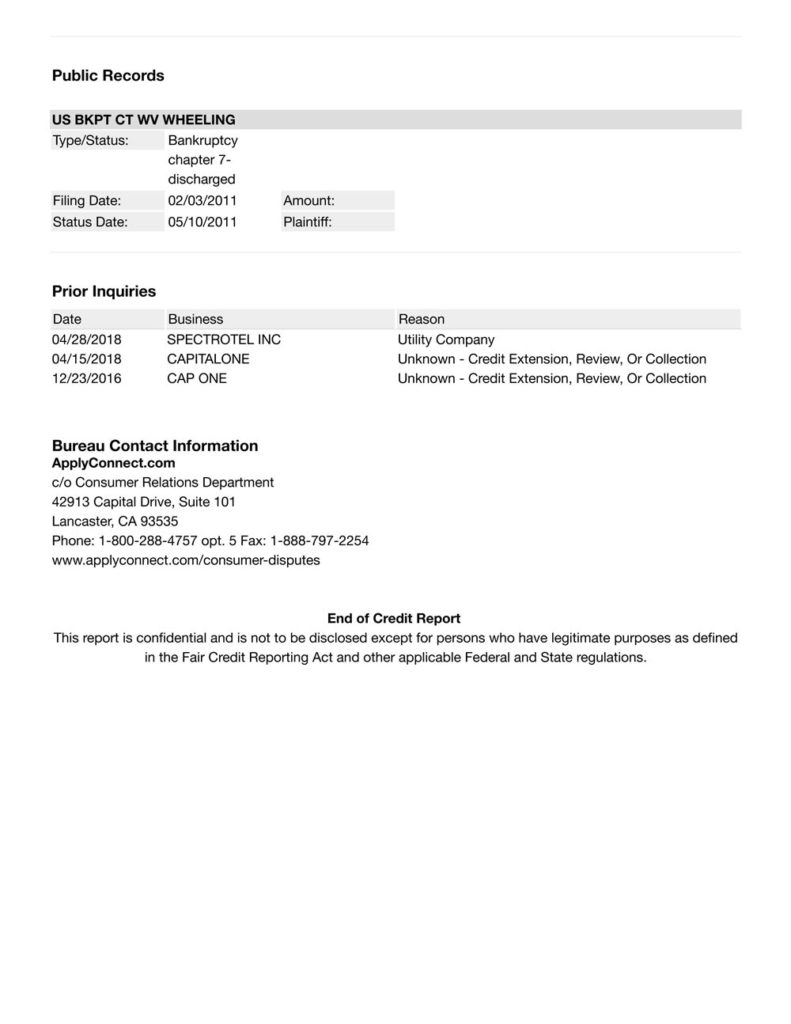

Public Records, Collections, and Resources

Public Records

If an applicant has public records that could impact how qualified they are to be approved for a rental property - ApplyConnect will include it on the report. Each credit report ends with resources to show other companies that have reviewed the applicant's credit recently, as well as contact information for the applicant to learn more about how ApplyConnect collected their information.

- Bankruptcies

- Prior Inquiries

- Experian Contact Info

- ApplyConnect Contact Info

Renter Credit Checks Loaded with Information

Experian Credit Report

Each Experian credit report begins by displaying the applicant's information as available within their consumer profile with the bureau. ApplyConnect reports also begin with a visual aid to show the applicant's credit risk score, as calculated using the VantageScore.

- Applicant Name

- Current Address

- Previous Address(es)

- Employer

- VantageScore

- Credit Score Risk Factors

Profile Summary and Payment History

Summary and Tradelines

ApplyConnect credit reports include several pages of tradelines demonstrating the applicant's payment history, and a summary on top to provide an easy to read overview that can help in decision making to determine whether they are likely to pay rent on time.

- 24 Month History

- Real Estate Accounts

- Revolving Credit

- Installment Accounts

- Total Open Accounts

- On-Time Payments

- Late Payments

- Monthly Debts (est.)

- Available Credit

- Collection Accounts

Public Records, Collections, and Resources

Public Records

If an applicant has public records that could impact how qualified they are to be approved for a rental property - ApplyConnect will include it on the report. Each credit report ends with resources to show other companies that have reviewed the applicant's credit recently, as well as contact information for the applicant to learn more about how ApplyConnect collected their information.

- Bankruptcies

- Prior Inquiries

- Experian Contact Info

- ApplyConnect Contact Info

VantageScore Comes with All the Benefits

The VantageScore credit scoring model was created by the top three credit bureaus (Experian, TransUnion, Equifax) and proves to score more rental applicants than the FICO credit model.

Click to Expand

With a score ranging from 300 to 850, scores can be easily comprehended. ApplyConnect organizes that information into a user-friendly tenant screening report, complete with visuals.

VantageScore 3.0 accounts for changes in consumer behavior to provide you with consistent information. It’s use of granular data provides more predictive results. More accurate data is provided as post-recession data is analyzed.

VantageScore 3.0 was formulated to score consumers who were previously deemed unscorable by FICO standards. With its modern algorithm, VantageScore 3.0 allows for inclusivity as it has scored over 30 million previously unscoreable consumers.

VantageScore Comes with All the Benefits

The VantageScore credit scoring model was created by the top three credit bureaus (Experian, TransUnion, Equifax) and proves to score more rental applicants than the FICO credit model.

Click to Expand

With a score ranging from 300 to 850, scores can be easily comprehended. ApplyConnect organizes that information into a user-friendly tenant screening report, complete with visuals.

VantageScore accounts for changes in consumer behavior to provide you with consistent information. It’s use of granular data provides more predictive results. More accurate data is provided as post-recession data is analyzed.

VantageScore was formulated to score consumers who were previously deemed unscorable by FICO standards. With its modern algorithm, VantageScore allows for inclusivity as it has scored over 30 million previously unscoreable consumers.

Do You Know the Facts about Credit Reports?

Find out if you know the truth behind these common credit reporting myths.

MYTH

FACT

MYTH

FACT

CLICK HERE FOR MORE ON EVICTION CHECKS

MYTH

FACT

MYTH

FACT

FACT: While VantageScore and FICO are the most widely used and follow the same scoring range and “the higher, the better” guidelines, there are tons of unregulated, non-standard credit scoring models available that do not follow these guidelines.

FACT: Most evictions won’t appear on the credit report. The credit bureaus report on less than 10% of eviction cases, and only if it resulted in a monetary judgment. The National Consumer Assistance Plan (NCAP) has reduced this even further.

FACT: While VantageScore and FICO are the most widely used and follow the same scoring range and “the higher, the better” guidelines, there are tons of unregulated, non-standard credit scoring models available that do not follow these guidelines.

FACT: Under the Fair Credit Reporting Act (FCRA) you have a right to dispute incomplete or inaccurate information on your credit report by contacting the consumer reporting agency. By law they’ll have to investigate and correct/remove the record within 30 days.

ApplyConnect is Always Improving

Experian, Equifax, and TransUnion initiated their National Consumer Assistance Plan (NCAP) in 2017 to improve the quality of the public record data you depend on. Their new standards require a consumer’s name, address, social security number, and date of birth to be on all civil judgment and tax lien data. Since the implementation of NCAP, a significant amount of civil judgment and tax lien data does not meet the new standards and the presence of such records will not be reflected on the credit report.

To supplement for this change in credit reporting standards, ApplyConnect provides an eviction history scan to each of our tenant screening reports, letting you breathe easy.

ApplyConnect is Always Improving

Experian, Equifax, and TransUnion initiated their National Consumer Assistance Plan (NCAP) in 2017 to improve the quality of the public record data you depend on. Their new standards require a consumer’s name, address, social security number, and date of birth to be on all civil judgment and tax lien data. Since the implementation of NCAP, a significant amount of civil judgment and tax lien data does not meet the new standards and the presence of such records will not be reflected on the credit report.

To supplement for this change in credit reporting standards, ApplyConnect provides an eviction history scan to each of our tenant screening reports, letting you breathe easy.

Learn More About the ApplyConnect Report

ApplyConnect’s goal is to be as transparent as possible. Know exactly what you’ll get when you choose ApplyConnect’s online tenant credit checks. Learn more about our tenant credit and background check reports.

Learn More About the ApplyConnect Report

ApplyConnect’s goal is to be as transparent as possible. Know exactly what you’ll get when you choose ApplyConnect’s online tenant credit checks. Learn more about our tenant credit and background check reports.