ApplyConnect has released credit, criminal and eviction data for January through March, 2019 and discovered that your tenant’s FICO scores trended downward. ApplyConnect’s quarterly data analysis highlights the number of rental applicants that have criminal and eviction records on their tenant background checks, as well as the average FICO credit score. Compared to last quarter (October to December 2018), the average FICO score has fallen, however, it’s likely that this dip is a result of your applicant’s holiday spending.

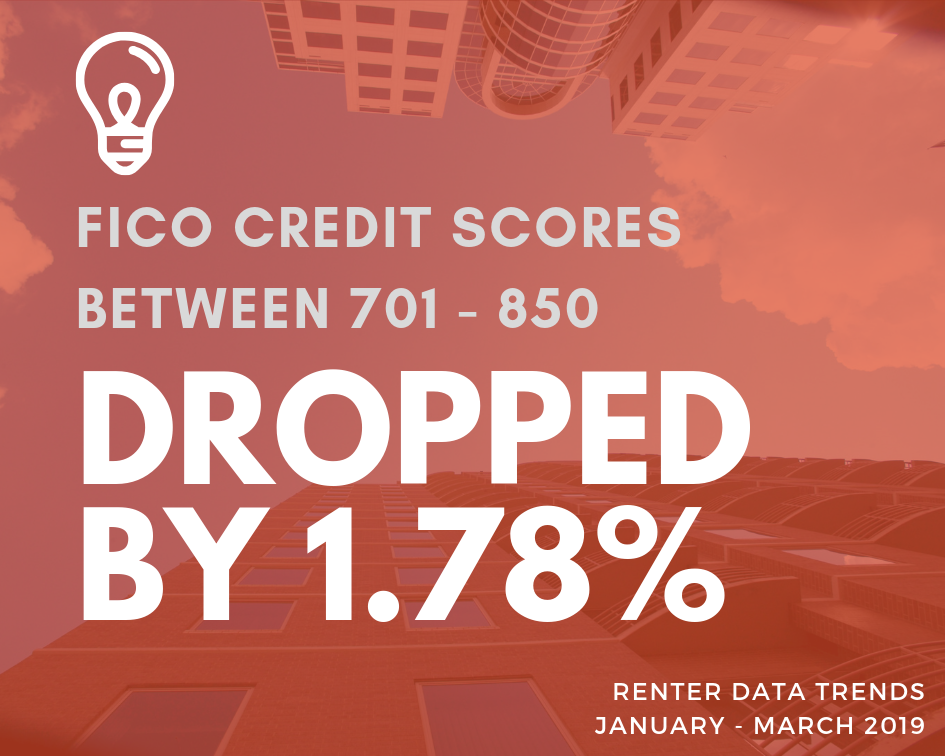

FICO Credit Scores Take a Dip in Q1

Unlike last quarter (October to December 2018), ‘excellent’ and ‘good’ credit scoring ranges (scores between 701-850) dipped by 1.78% while ‘poor’ and ‘very poor’ ranges (scores between 300-640) rose by 1.74%. This immediate dip post-December is likely the result of rental applicants using credit cards to purchase their holiday shopping and fund their festivities.

According to Experian’s holiday survey, 39% of Millennials, 18% of Gen X-ers, and 56% of Baby Boomers indicated that they planned to pay for their holiday gifts in 2018 with a major credit card. Nearly a quarter (22%) of all surveyed reported that their holiday shopping would adversely affect their credit scores, with Millennials the most worried.

Why your Renter's FICO Score is Dropping

While credit scores can drop for multiple reasons, two common ones are:

- The payment was more than 30 days late

As always, payment history has the most significant impact on credit scores, and if the credit card payment was late, it could be reflected on your applicant’s credit score. - The purchase was unusually expensive

The second reason for the drop has to do with your applicant’s credit utilization ratio. This refers to how much of your available credit you’ve used – so big purchases can cause a credit score dip regardless if it’s payed in full by the due date.

- The payment was more than 30 days late

Although credit scores have started to bounce back in March (whew!), it’s unknown weather this credit trend will continue to rise or plateau in the next quarter.

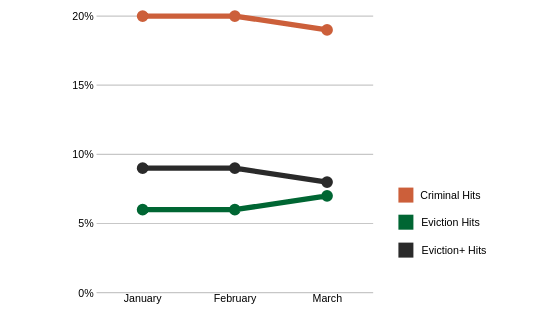

Criminal and Eviction Hits See Minimal Changes

Since last quarter, the number of rental applicants with criminal or eviction records has stayed relatively consistent. Among all applicants processed, an average of 19.51% produced a criminal hit, 6.5% produced an eviction hit, and 8.7% had an eviction+ hit. Overall, this quarter showed that roughly 80.49% of applicants had no criminal hits on their tenant screening report.

What's the Difference Between CIC's Eviction vs. Eviction+?

Eviction

A nationwide search of a proprietary database of 36+ million reportable unlawful detainer (eviction) records, no duplicates.

Eviction+

An enhanced version of the nationwide eviction database scan that cross references applicants with additional addresses associated with their consumer profile.

As new rental applicant eviction, criminal and credit scoring background check data gets released, keep this in mind when you revise your property’s rental criteria. Click here to subscribe for future updates.