Report Rent Payments

In addition to making it easy for your tenants to pay rent each month, they'll have the added benefit of building their credit with each payment. PayRent reports your tenants' payments, whether positive or negative, to all three major credit bureaus - Experian, TransUnion and Equifax.

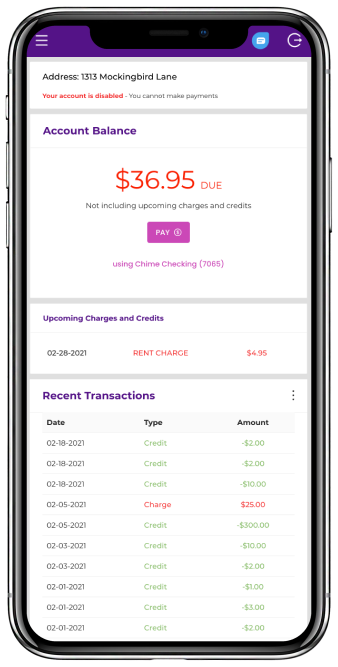

Automate Rent Collection

The tools and features included with your PayRent account allow you to setup each property with ways of automating the way you collect rent each month. This includes payment reminders and late fees to keep your tenants informed about their financial expectations while renting your property.

Safe & Secure for Rentals

All sensitive information, such as tax and bank details, are stored in PayRent's hacker-proof vault. Rent payments go through a secure real-time bank balance verification before payments are made, and your personal bank information is kept completely private.

Rent Collection Protection

RentDefense™ is a unique collection of features available through PayRent to provide you with a financial safety net from tenants who stop paying. Using a combination of bank balance verification and payment controls, RentDefense™ helps make sure you get paid when it's due and protects you from lost rent.